Section 08: Tech Infrastructure Metrics

Business Climate Metrics

Several business climate and workforce metrics were added to the tech infrastructure section in last year’s report

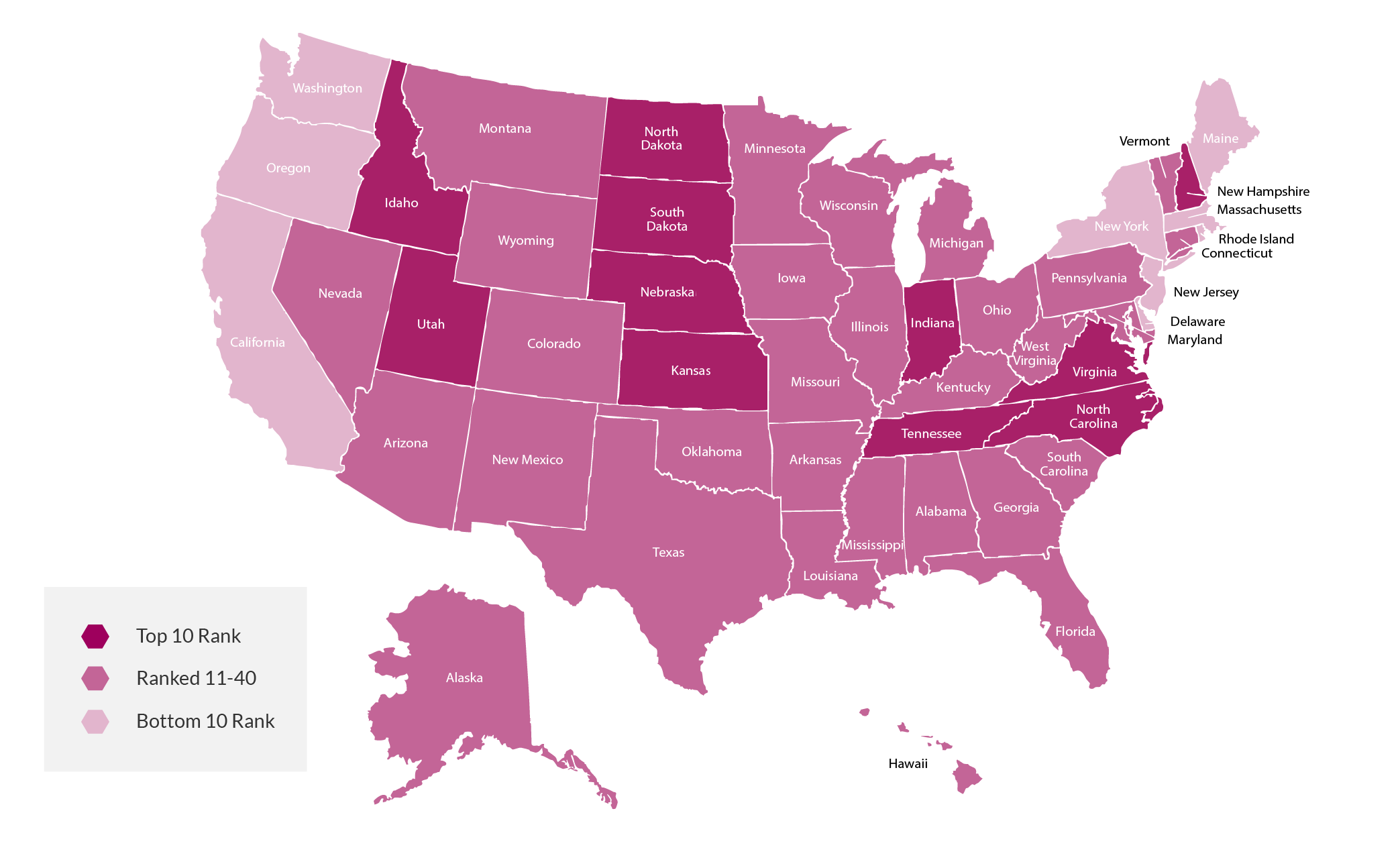

A supportive business climate is crucial in states where the tech sector is prominent, as strong policies and incentives can attract high-growth firms, skilled talent, and venture capital. By fostering a competitive regulatory and tax environment, North Carolina can continue to strengthen its appeal as a hub for innovation. North Carolina ranks #4 in Business Friendliness.

Business Friendliness Ranking 2025

Source: CNBC America's Top States for Business 2025

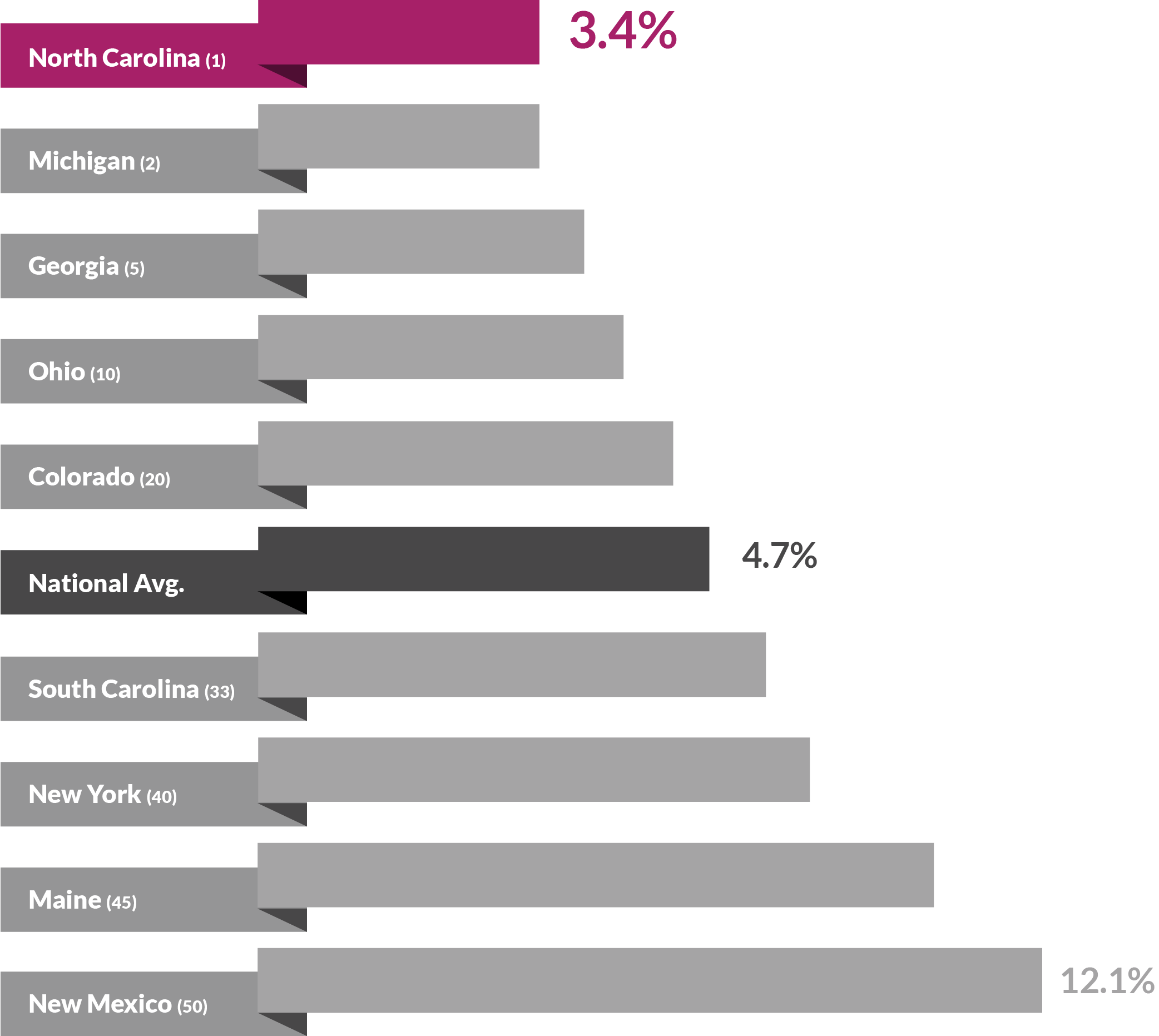

Total Effective State Business Tax, 2024

North Carolina has the #1 Lowest Effective business tax rate in the nation

North Carolina scores well on business friendliness as ranked by CNBC. The state is also tied for the lowest effective business tax rate in the nation. Competitive tax rates can help recruit new businesses and retain existing companies.

Source: Council on State Taxation (2024)

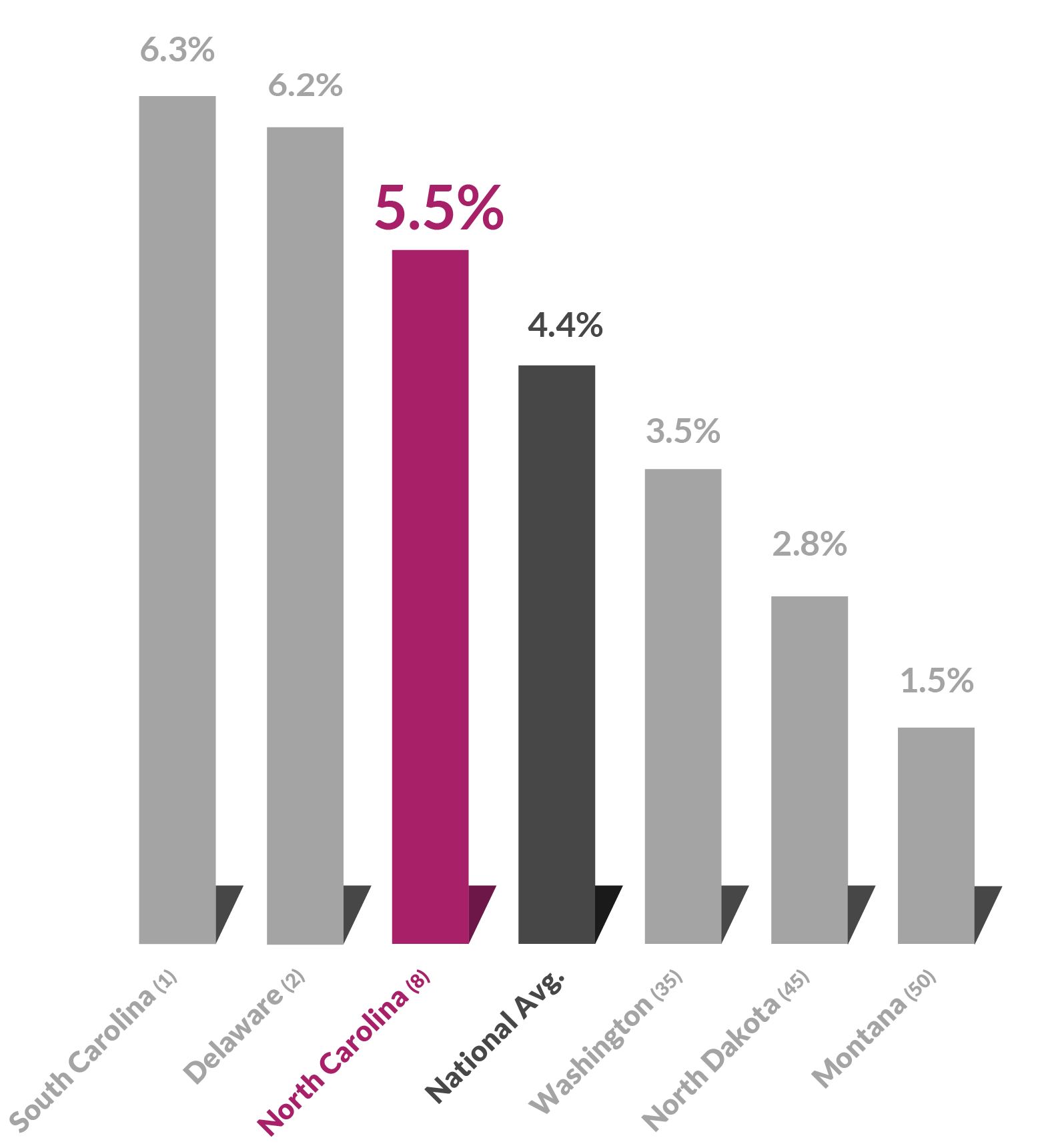

5.5% of all employment in North Carolina was attributable to foreign-based companies

Foreign direct investment (FDI) was measured to understand the state’s global competitiveness. FDI can bring capital, new technologies, and expand the region’s tech ecosystem. The most recent data, from 2022, show an increase from 5.3% the previous year. The state also moved up in the rankings from #9 to #8.

Source: EL calculations based on BEA (2025)

FDI Employment as a Percentage of Total Employment, 2022

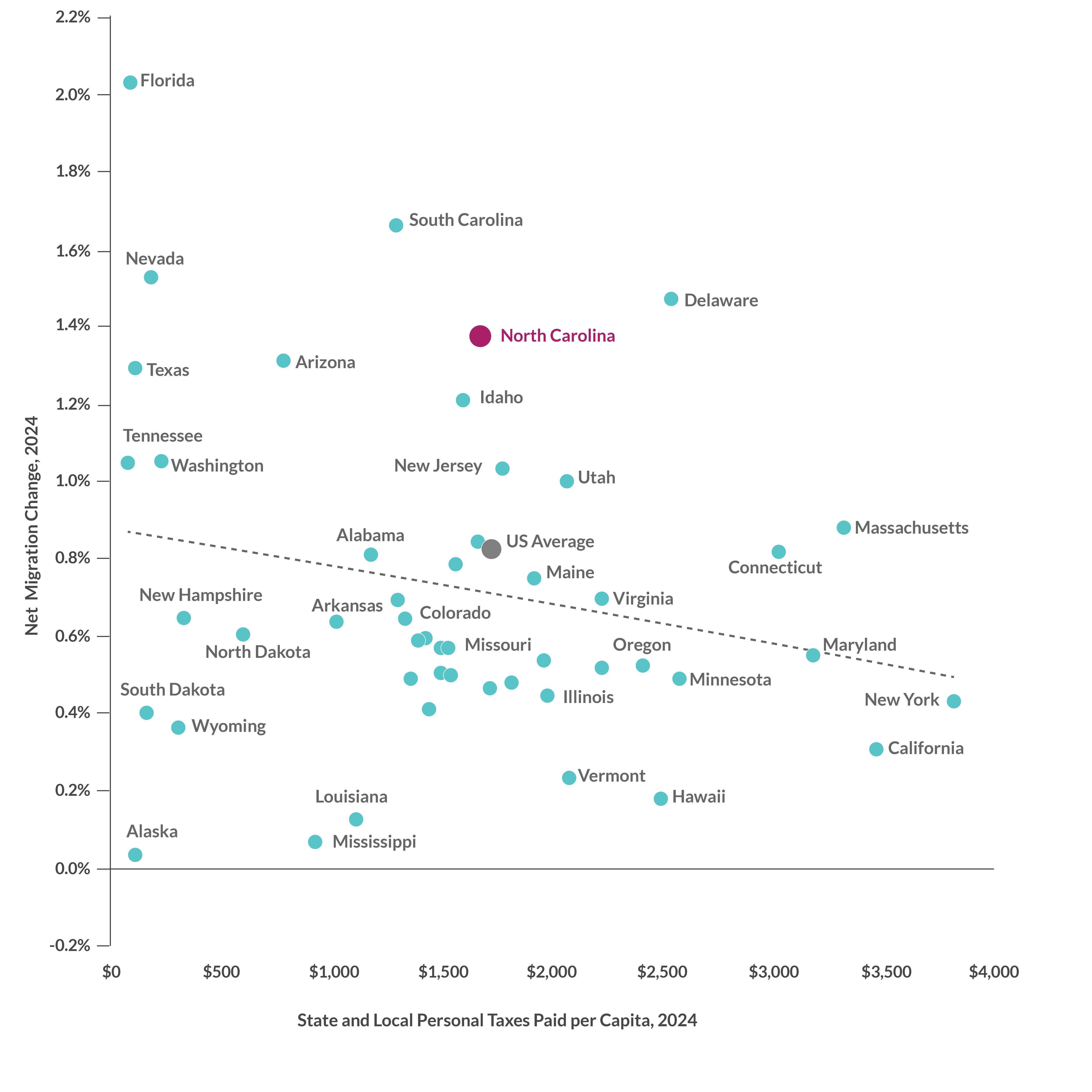

Net Migration vs state & Local personal taxation

As workforce remains a key challenge in the tech sector, specific data influencing the size of the state’s talent pool were evaluated. Migration into the state can help expand the workforce. As noted earlier in this report, North Carolina’s migration has increased in recent years. The state’s net migration rate in 2024 was 1.38%, the #4 highest in the country. Recent migration patterns have generally followed state tax trends, though with some exceptions. States with the lowest income taxes tended to attract the highest rates of new residents, but low personal taxes did not guarantee strong in-migration. North Carolina’s average personal taxes per person during this period were just below the national average, ranking #21 across all states.

Source: EL calculations based on US Census Bureau (2025) and BEA (2025) Note: The tax per capita value includes state and local taxes on income, personal property, motor vehicle licenses, and other taxes on personal licenses by US residents. The figure does not include federal taxes or sales, residential property, or production activity taxes.

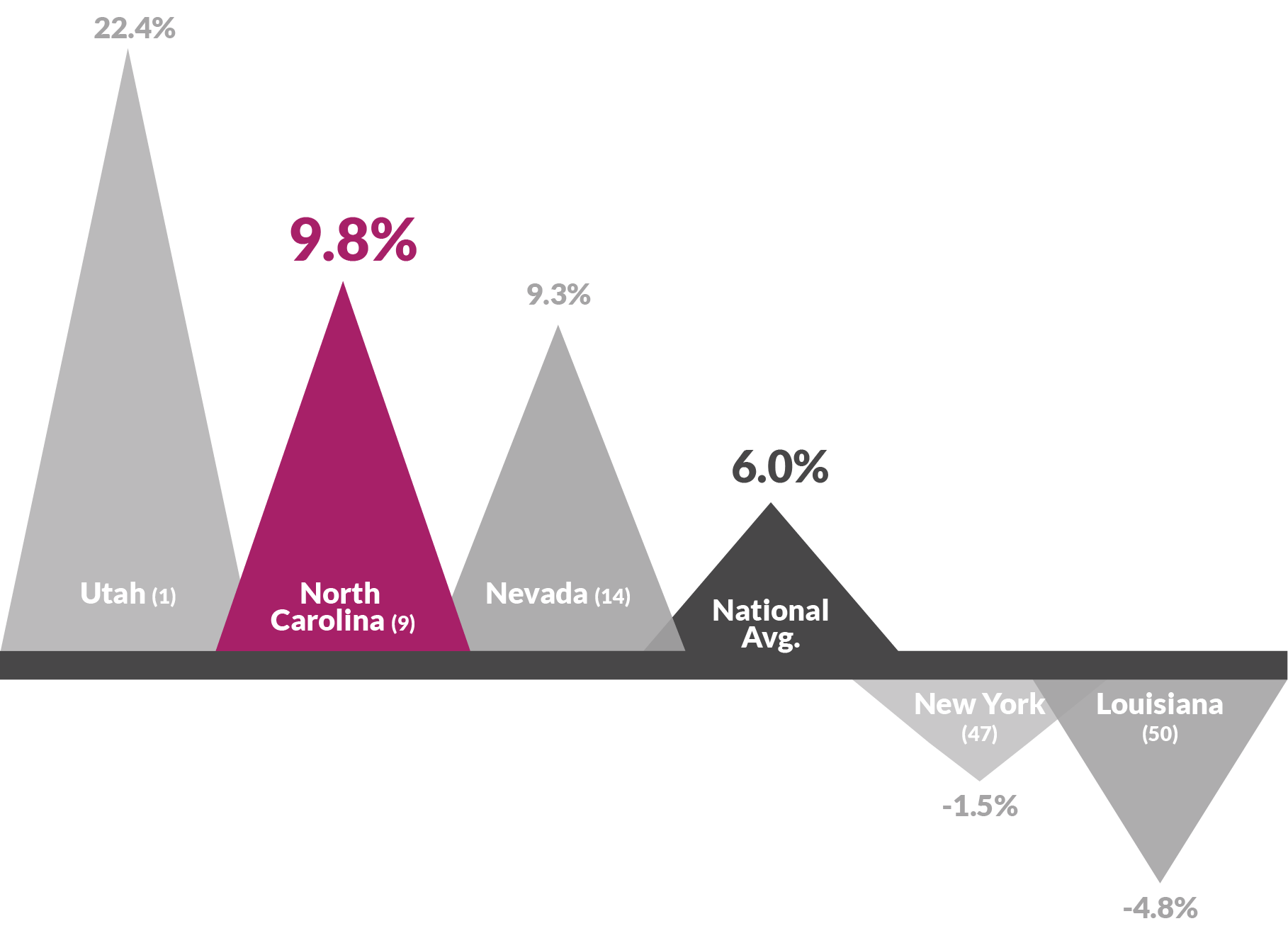

North Carolina’s working-age population is projected to grow by 9.8% over the next ten years

Migration is only one component of overall workforce size. North Carolina is ranked the #9 highest rate in the nation. Several states are expected to see declines in their working-age population during this period. As companies tend to locate where they can find workers, these trends help North Carolina remain competitive in today’s talent wars.

Source: EL calculations based on Lightcast 2025.4

Projected Working Age (25 to 64) Population Change, 2025-2035

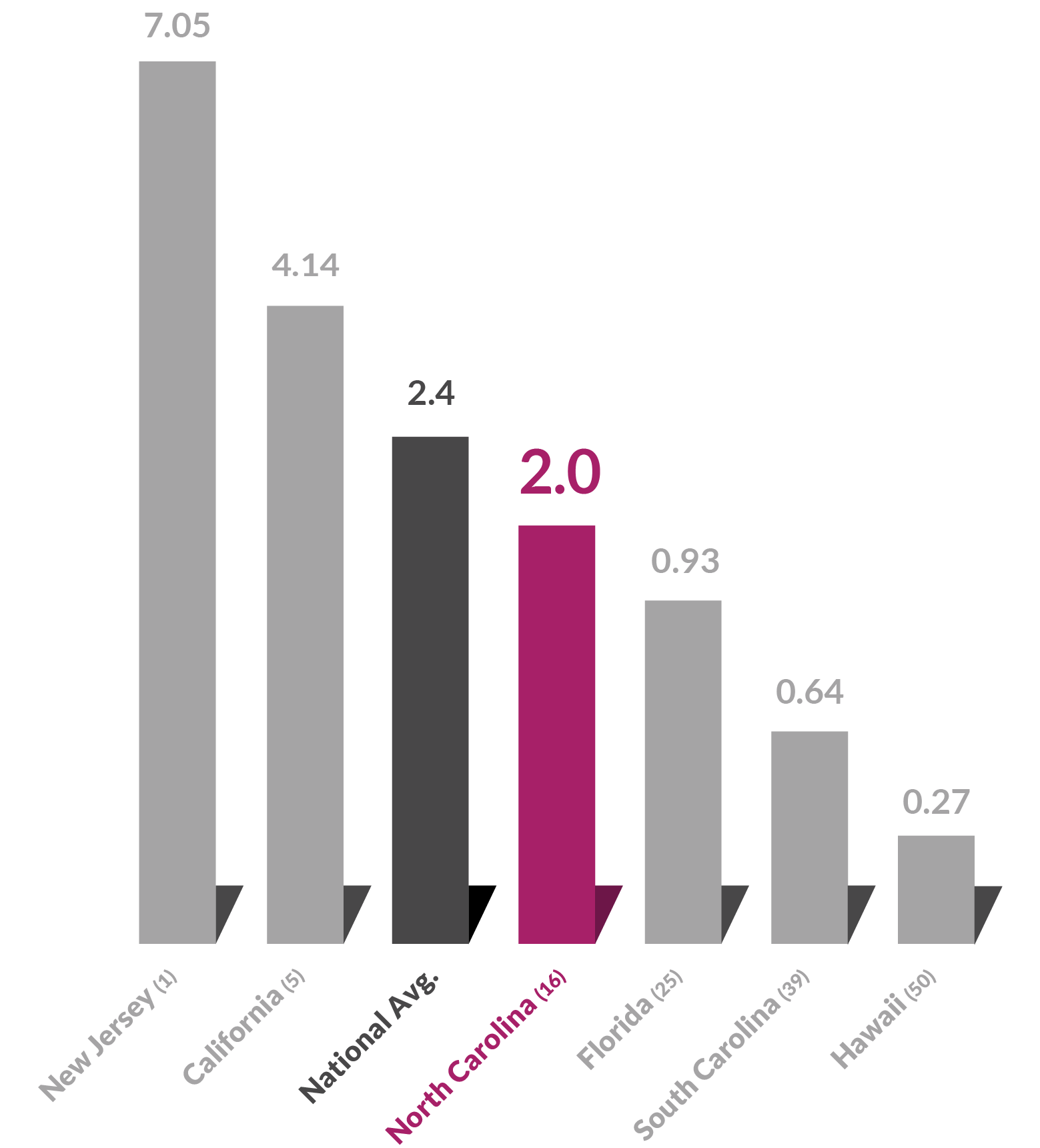

H-1B Visa Beneficiaries Per 1,000 Workers, 2024

Another way to expand the labor pool in North Carolina is through immigration

The tech sector has often utilized H-1B visas, which allow firms to bring high-skilled international talent to the U.S. By supporting the influx of specialized workers, these visas help address domestic skill shortages and enhance productivity. In 2024, North Carolina used H-1B visas at a lower rate than the national average. The state ranked in the middle of the pack at #16.